Rates are going up, but not by as much in previous years. Photo: File.

Household rates will resume their march upwards in 2021-22 with an average 3.75 per cent rise as part of the next five-year phase of the ACT Government’s 12-year tax reform program.

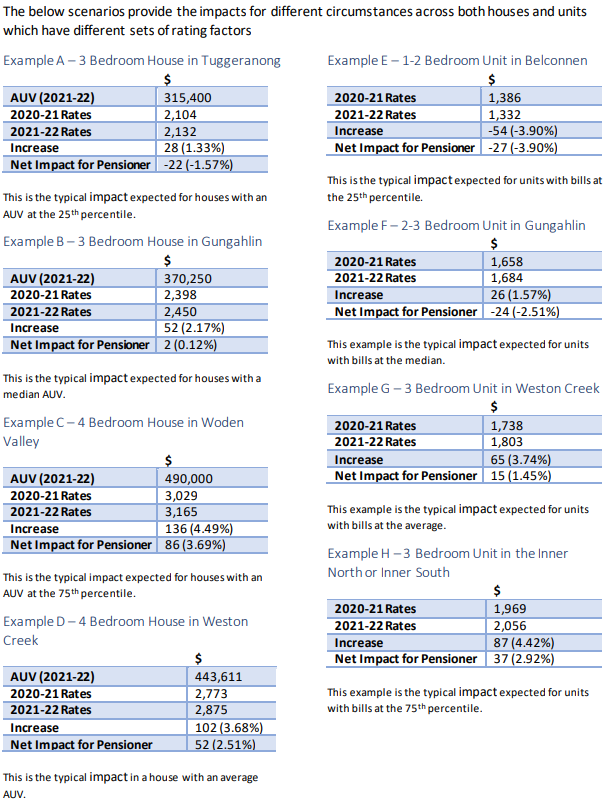

The government has not released a suburb by suburb guide to rates rises as in previous years but a series of examples for house and unit owners in differing circumstances (see below).

For example, the bill for owners of a four-bedroom house in the Woden Valley with an average unimproved value (AUV) of $490,000, the highest example given, will be $136 (4.49%) more than in 2021-22.*

For pensioners, that will be $86 (3.69%), thanks to the pensioner rates rebate cap increasing by $50 to $750, which the government says will assist almost 15,000 households.

The owner of a three-bedroom house in Tuggeranong with an AUV of $315,000 will only pay $28 more (1.33%). A pensioner will actually pay $22 less.

The increase comes after a pause in 2020-21 to provide relief during the pandemic-induced economic slowdown, but the government says the heavy lifting has been done in the reform program and rates increases will be lower than in previous years during the next phase.

It is still providing some support, saying it will be directed at those who most need it.

The fixed charge component of household rates will be reduced, which Chief Minister Andrew Barr says will mean lower increases for properties with lower unimproved values and make the tax system more progressive.

For a unit, it will come down from $958 to $850, and for a non-unit from $823 to 800.

On top of this and the pensioner rates rebate cap increase, there have been recently announced increases in the utilities concession from $700 to $800 for around 31,000 households in 2021-22.

Other examples cover Tuggeranong, Gungahlin and Weston Creek, as well as Belconnen, and the Inner North and South for units.

New rate tables for the ACT. Image: ACT Government.

Mr Barr said the one-off $150 rates rebate to help offset general residential rates increases last year provided significant support across the community while retaining the fundamentals of the tax reform program.

“For almost two-thirds of Canberra residential property owners – 110,000 households – rates did not increase,” he said.

Opposition Leader Elizabeth Lee said in February, when Mr Barr handed down the first of two budgets this year, that despite promising a rates reprieve, 60,000 Canberrans still faced rates rises last year.

Mr Barr said the government would continue to cut stamp duty further, and details of the 2021-22 duty cuts would be announced at the start of the new financial year.

“By abolishing inefficient taxes such as stamp duty and replacing this revenue with our fairest and most efficient tax base, we increase economic activity and the productive capacity of the economy,” he said.

“A more stable revenue base also allows for the planning of long-term investments in key services such as health, education, community services and transport.”

Mr Barr announced in February that average general rates for residential and commercial properties would increase by 3.75 per cent each year from next financial year until 2025-26.

A government spokesperson said the suburb by suburb breakdown table was simply an average based on the varying AUV and housing types in any particular suburb but within each suburb there will be a wide variety of land values and dwelling types.

The government will provide aggregated information on the rates paid by the varying sizes and types of dwellings in suburbs with, or before, the 2021-22 ACT Budget in August.

Canberrans can expect to receive their rates notices via email or in the post over the coming weeks, including detailed information on their rates.

Canberrans can also visit the ACT Revenue Website to access a Rates and Land Tax calculator on 1 July, input their property AUV and determine their household general rates for the upcoming financial year.

To learn more, including cost-of-living assistance, visit www.revenue.act.gov.au.

* The key factors for houses are the average unimproved value of your property, the change in that average unimproved value over a five-year period relative to the change for other properties, and the rating factors split across the fixed charge and variable charge.

All scenarios for 2020-21 rates are calculated prior to the application of the one-off $150 rebate.

Original Article published by Ian Bushnell on The RiotACT.