The housing divide is becoming more pronounced in Canberra as prices and rents soar. Photo: Michelle Kroll.

Two reports this week have highlighted the growing housing divide in the ACT, in the rental market, and between renters and homebuyers.

Read as a whole, the findings show a worsening situation for renters paying out more of their income to keep a roof over their heads while facing more competition from the growing number of people being locked out of a white-hot housing market increasingly disconnected from Australian workers’ stalled incomes.

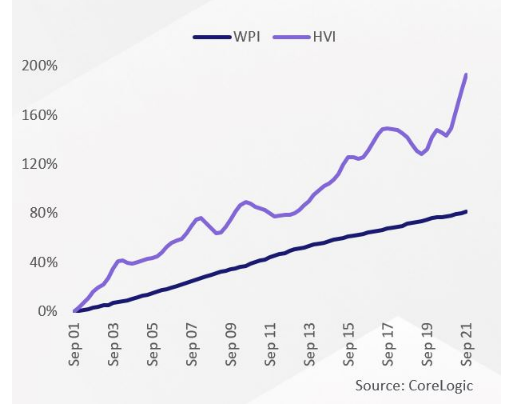

The 2021 Rental Affordability Index shows Canberra is the least affordable city for low-income renters in Australia, while CoreLogic has compared wages data with property values for the past two decades, revealing just how much home prices have outstripped the total change in wages and salaries.

While ACT wages increased 81.5 per cent in the past 20 years, home values in the national capital have grown 224 per cent, exacerbated by a more than 25 per cent gain in the past 12 months.

Canberra’s wage-price gap is the second biggest in the country, behind Tasmania, followed by Victoria and NSW.

Cumulative growth in Australian wage price index (private and public sectors, original) and CoreLogic Home Value Index (national dwellings, September 2001 to September 2021). Charts: CoreLogic.

Nationally, annual wage growth has been languishing for years and is only just getting back to the decade average of 2.4 per cent. The ABS recorded a 2.2 per cent gain in the year to September.

The market is awash with cheap money feeding demand and inflating prices, but ironically, higher wages growth, along with lower unemployment, are the factors the Reserve Bank is waiting on before moving on interest rates.

The result is many first home buyers are unable to save the 20 per cent deposit needed for a mortgage, or those that do face mortgage stress.

CoreLogic says that in the year to October 2021, a 20 per cent deposit on the median Australian dwelling value has increased by $25,417, to a total of $137,268.

CoreLogic 20-year growth in Australian WPI (private and pubic sectors, original), and home value index dwellings, September 2001 to September 2021 by state and territory.

In Canberra, the median dwelling value in October was $864,909, requiring a deposit of $173,000, a staggering figure even for the ACT’s relatively well-paid government or government-connected workers.

The consequence is that more are left behind in an already congested rental market, being charged the highest rents in the country.

For those on reasonable incomes, the biggest problem is finding the right property, but for those in the lesser paid sectors such as hospitality and retail, or pensioners on fixed incomes, more than 60 per cent of their income could be going on rent, according to the Rental Affordability Index.

For those on JobSeeker, the share of income is an impossible 113 per cent.

The index shows that for a single pensioner, the figure is 68 per cent, a pensioner couple 51 per cent, and for a single part-time worker parent on benefits, it’s 63 per cent.

It says the ACT is ‘moderately unaffordable’ to the average ACT rental household, although bordering on ‘acceptable’, but low-income households, such as the student sharehouse and hospitality worker household profiles, face particularly unaffordable rents, which are pushed up by the overall high-income earning workforce.

The suburban areas of Gungahlin, Belconnen, Molonglo Valley, Weston Creek, and Tuggeranong have shifted from acceptable to ‘moderately unaffordable’.

The index found the collapse of international tourism and student demand due to the pandemic had meant cheaper rents for one and two-bedroom dwellings, giving singles, couples without children, or small families a bit more breathing space.

However, this has coincided with rising rents for larger dwellings, intensifying pressure on family households that require dwellings of three bedrooms or larger.

New public housing in Dickson. More is required and quickly, says ACTCOSS. Photo: File.

ACTCOSS Acting CEO Craig Wallace said the situation required government intervention, including the full delivery of the ACT Housing Strategy and additional public and community-controlled build-to-rent housing.

“This requires direct investment from the ACT Government and changes to planning to free up more land for affordability and reduce costs and barriers for community housing providers,” he said.

“Our planning system can help increase community confidence in new affordable housing development by ensuring community facilities, infrastructure and transport links are baked in at the design stage.”

Mr Wallace said the Federal Government should commit to funding a national social housing construction program, boost Commonwealth Rent Assistance, and support and extend affordable housing rental incentive programs to generate new supply.

The 2018 ACT Housing Strategy is a 10-year, $100 million commitment that aims to deliver 400 additional public housing dwellings and the renewal of 1000 and 200 community housing homes.

The ACT Government is also pursuing build-to-rent options. It has rejected as simplistic calls for more land releases to help ease price growth, pointing the finger at Federal tax settings.

The index was prepared by SGS Economics and Planning for National Shelter and the Brotherhood of St Laurence.

Original Article published by Ian Bushnell on Riotact.