Housing in Coombs, one of the big movers in prices over the past 12 months. Photo: Ian Bushnell.

ACT house prices have done what they have threatened all year to do – gone into retreat after riding high for nearly three years.

CoreLogic’s latest data for May show overall residential property holding steady, edging down just 0.1 per cent, but stand-alone houses, after falls in some Canberra suburbs already this year, dipped 0.4 per cent.

It may provide some hope to potential buyers, but many have already switched to cheaper apartments and townhouses after hitting the price wall.

Subsequently, prices in the medium and high-density sectors rose in May by nearly a percentage point (0.9 per cent).

While Canberra now seems to have joined the rest of the country in being impacted by higher interest rates, stricter lending rules and affordability limits, it must be remembered that homeowners have enjoyed massive gains over the past couple of years and are still way ahead after house prices rose 18.7 per cent overall over the past 12 months.

So any falls, for now, are still marginal, and first-home buyers still face big borrowings to get into the market, especially for a house, a daunting prospect in a period when interest rates are set to rise further.

The median house price sits at well over a million dollars, and the median unit price continues to rise and is now more than $622,000.

So far this year, house prices are up 3.9 per cent and units and townhouses, the big movers, rose 6.1 per cent.

CoreLogic said suburbs, where prices fell in the February-April quarter this year, included the wealthy inner north’s Ainslie (-3.4%), Dickson (-3%) and Watson (-2.2%).

Weekend auction listings and results have fluctuated in recent weeks, ranging from as low as only 43 two weeks ago to 80 last weekend, interestingly, a long weekend.

But the clearance rate last weekend was just 63.4 per cent, with the median sale price slipping below the million dollar mark ($849,000), although the top 10 sales were still above $1 million.

Nonetheless, it suggests properties are taking longer to sell and sellers can’t expect to get the results of the past couple of years.

CoreLogic data also shows the Weston Creek-Molonglo region dominating its top 10 for price growth over the past 12 months with phenomenal results.

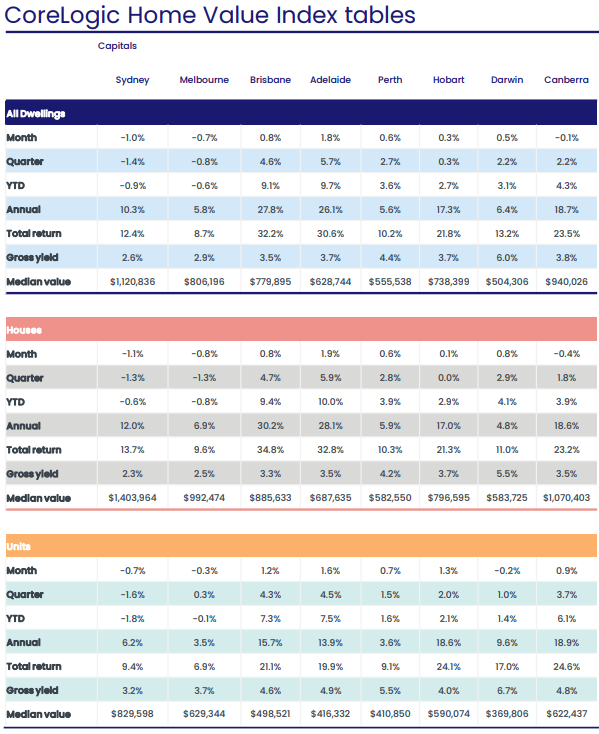

CoreLogic Home Value Index Tables. Image: CoreLogic.

Denman Prospect recorded a median price of $1,221,771 and massive 32.9 per cent increase, followed by Waramanga ($971,167; 30.7%), Coombs ($760,037; 29.8%), Stirling ($1,196,752; 27.5%) and Wright ($557,399; 25.8%).

Holder, in eighth place, had a median price of $1,058,691 and a 25.2 per cent gain.

The other suburbs were in the north – Harrison ($1,058,691; 25.2%), Macgregor ($887,588; 25.2%), Forde ($1,273,881; 24.8%) and Throsby ($1,232,407; 24.6%).

Nationally, the housing market just dipped into negative territory at 0.1 per cent, the first decline since September 2020.

CoreLogic’s research director Tim Lawless said rising interest rates had made an impact, but conditions had been weakening over the past year.

Mr Lawless noted the quarterly growth rate in national dwelling values peaked in May 2021, shortly after a peak in consumer sentiment and a trend towards higher fixed mortgage rates.

“Since then, housing has been getting more unaffordable, households have become increasingly sensitive to higher interest rates as debt levels increased, savings have reduced and lending conditions have tightened,” he said.

“Now we are also seeing high inflation and a higher cost of debt flowing through to less housing demand.”

But strong employment and potential wage increases were rays of hope as interest rates normalised.

Clarity Home Loans managing director Mark Edlund said that while the interest rate rise impacted demand, the election of a Labor Government and likely expansion of the public service and pay rises for public servants would probably mean ongoing stability for the Canberra market.

Mr Edlund said there had been a fall-off in web traffic since the rate rise, but the company was still getting a lot of inquiries.

Clarity had just experienced one of its biggest settlement months for off-the-plan sales as the construction phase ended, but demand for that product had been consistent over the past few years.

Mr Edlund said the feedback from house buyers was that it was easier to find a property and compete at an auction than six months ago.

“The competition isn’t there, plus there’s a little bit more stock on the market. There’s a closer alignment between expectation and reality,” he said.

Mr Edlund said buyers had become more cautious about taking on big mortgages, especially first-home buyers who had never experienced rising interest rates.

Original Article published by Ian Bushnell on Riotact.