New homes taking shape in Denman Prospect: 3258 new rate-paying households were added across the Territory in 2023-24. Photo: Ian Bushnell.

Residential rates will rise by an average of 3.75 per cent in 2024-25, in line with Stage 3 of the ACT Government’s tax reform program (2021-22 to 2025-26).

But that will vary across the ACT, depending on where you live.

The increase or decrease in the average unimproved value of a property, or AUV, does not determine the percentage increase or decrease in rates that a household pays.

The AUV is only used to distribute the collection of rates revenue progressively across all houses. The government says this helps to deliver fairer outcomes – those with higher-value land paying more in general rates than those with lower-value land.

The ACT Budget papers say rates revenue will increase from $494.4 million in 2023-24 to $522.5 million in 2024-25.

This increase comprises the total rates collection for existing households increasing by 3.75 per cent and an estimated increase in revenue of 2 per cent due to new properties, re-classifications and lease variations.

During 2023-24, an estimated 3258 new rate-paying households were added to the total dwelling base of the Territory.

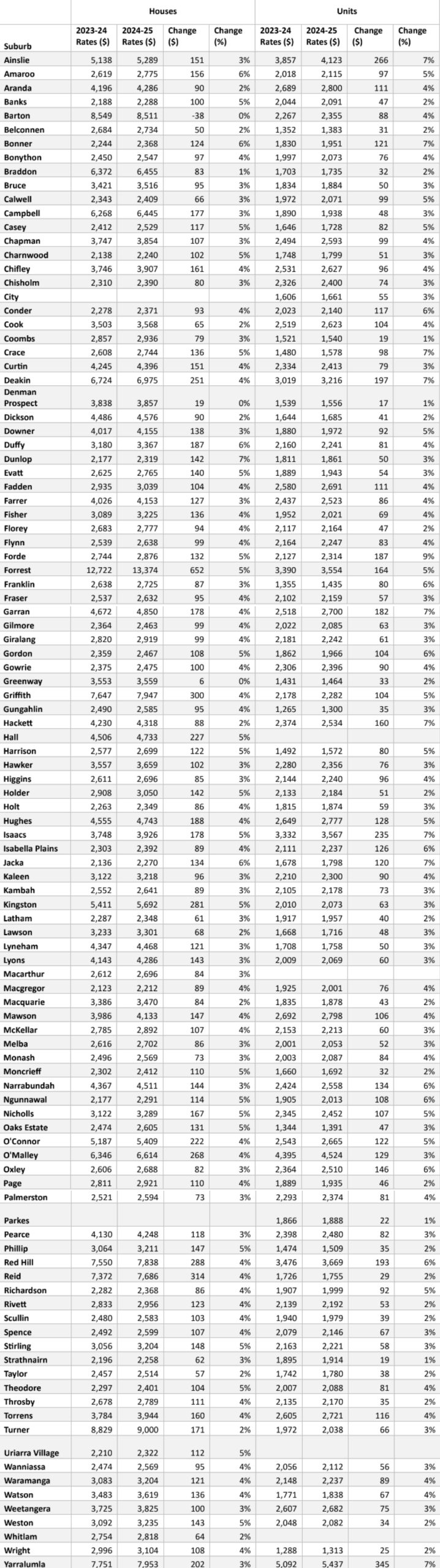

Rates changes across the ACT 2024-25. Image: ACT Government.

Original Article published by Ian Bushnell on Riotact.